What are the Signs You Might Need to File for Bankruptcy?

Not everyone who struggles financially has to file for bankruptcy. How do you know filing is the best option for you?

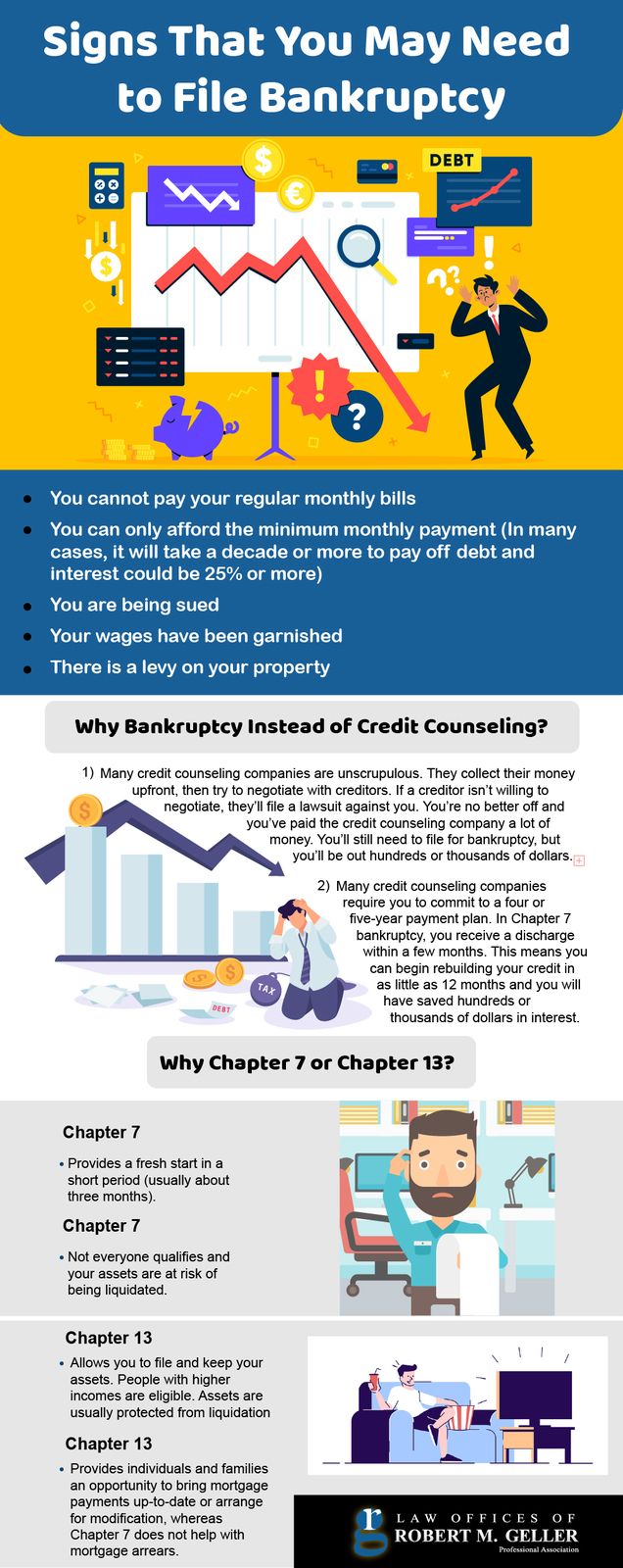

If you’re struggling to pay your bills on time each month or you’re only able to pay the minimum on each, it’s a sign that financial disaster might be ahead. Other signs bankruptcy should be on your radar include:

- A creditor files a lawsuit against you

- A levy is placed on your property

- Your wages are garnished

Why Would You Choose Bankruptcy Instead of Credit Counseling?

For some, credit counseling or negotiating with creditors is a better option than bankruptcy. However, not all credit counseling services are trustworthy.

In some cases, you’ll end up filing for bankruptcy eventually anyway, only you’ve wasted a bunch of money with the credit counseling service.

And remember, a Chapter 7 bankruptcy means your debts are discharged within a few months. Many credit counseling services require a commitment of four or five years.

Should I Choose Chapter 7 or Chapter 13?

How do you decide which chapter bankruptcy is better for you?

- Chapter 7 give you a fresh start in a short period of time, but not everyone qualifies. Chapter 7 also puts your assets at risk.

- Chapter 13 offers better asset protection, but it takes years to complete. However, it helps with mortgage arrears and is an option available to more people.

If you’d like to know more about whether the signs are all pointing you toward bankruptcy, let us know. Contact the Law Office of Robert M. Geller at 813-254-5696 to schedule a free consultation.

![Signs That You May Need to File Bankruptcy [Infographic]](https://djml3wkzi26ea.cloudfront.net/wp-content/uploads/2021/01/signs-chap7-v-chap13.jpg)

![How To File for Bankruptcy [Infographic]](https://djml3wkzi26ea.cloudfront.net/wp-content/uploads/2020/07/bankruptcy-steps-infographic-web.jpg)